Calculate DEDUCTIONS SAVING LOWERED COST with our farm equipment calculator

Time to think about next year’s harvest

Offer Valid Until 12/31/2023

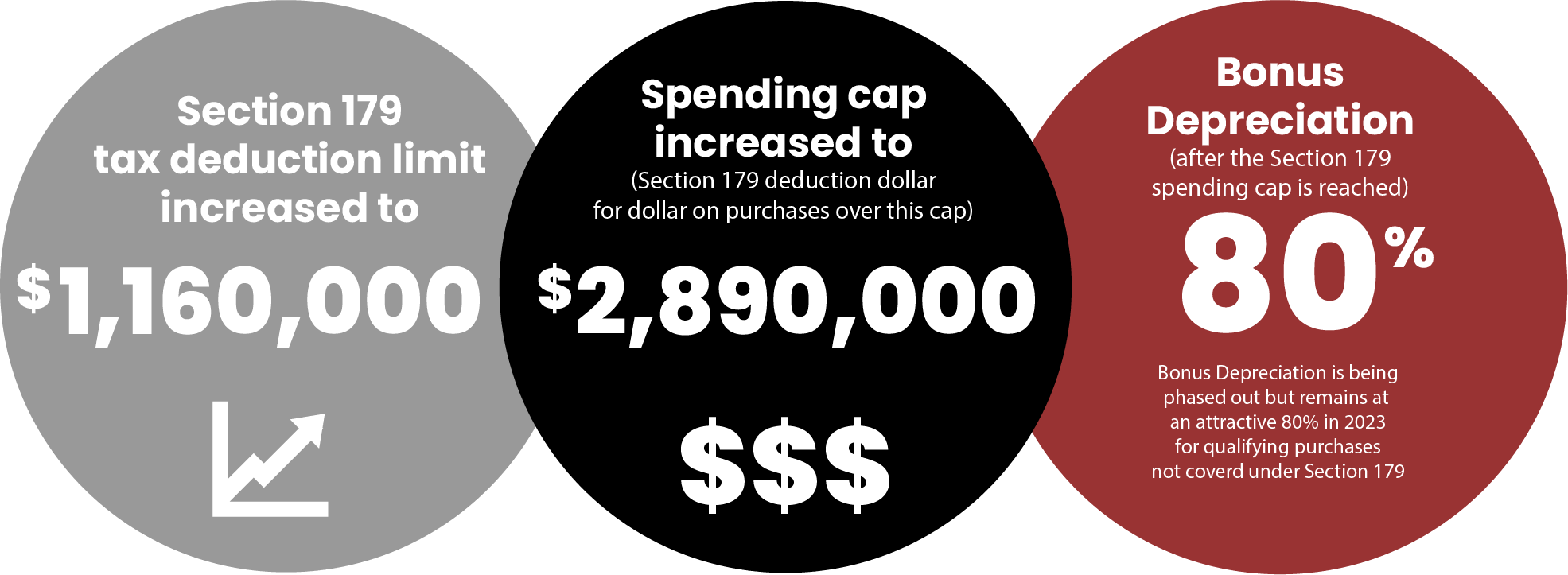

It’s time to get ahead for 2024! But we don’t need to tell you that, you’re farmers, harvesters, and agriculturists you have been planning! 2023 tax savings are here, reduce your taxable income on farm equipment purchases up to $1,160,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,890,000. The special depreciation allowance is 80% for certain qualified property acquired after September 27, 2017, and placed in service after December 31, 2022, and before January 1, 2024.